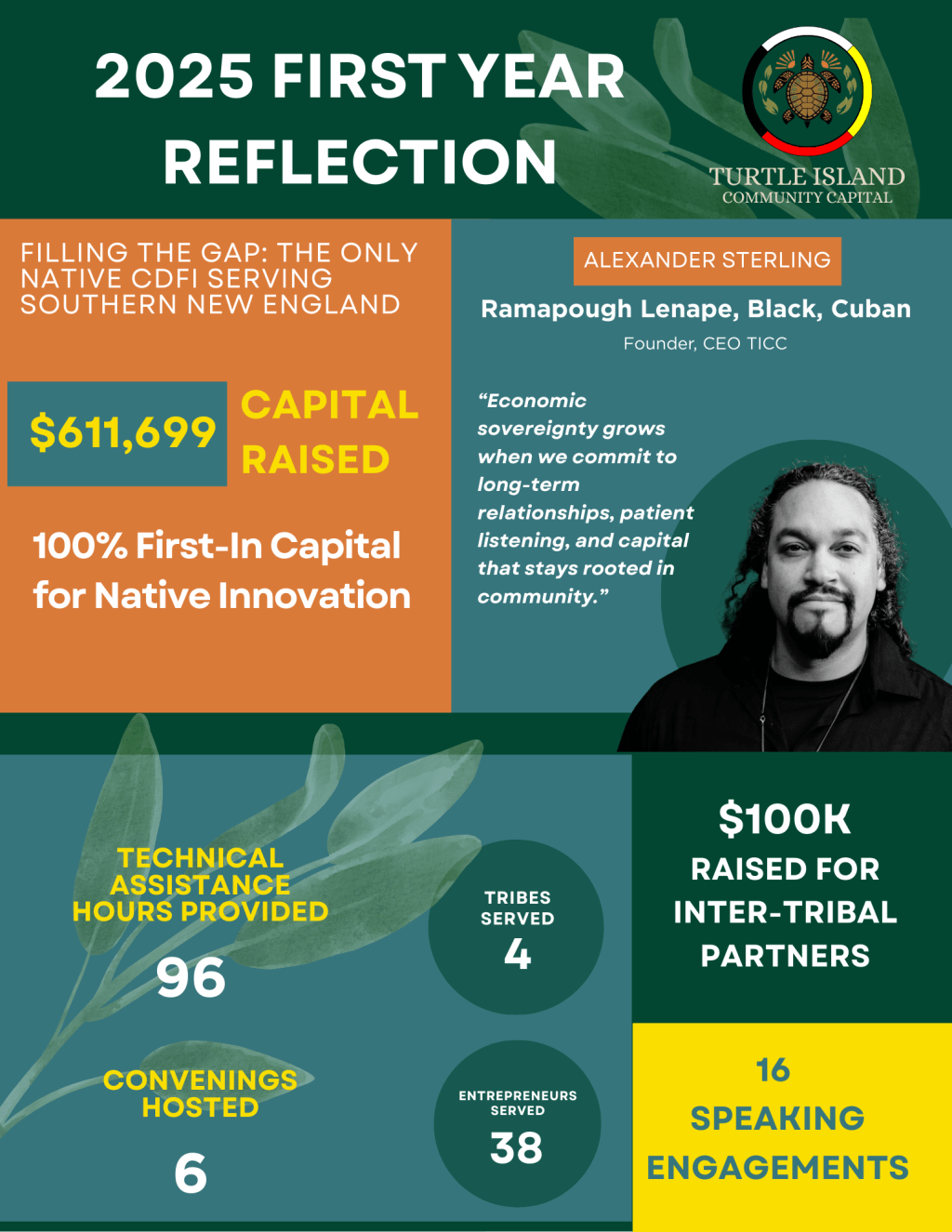

INVESTING IN

NATIVE COMMUNITIES

Turtle Island Community Capital (TICC) is a mission-driven financial institution dedicated to advancing economic sovereignty in Native and underinvested communities.

ICC has applied for independent 501(c)(3) status and is fiscally sponsored by:

TICC is on track to become a certified Native Community Development Financial Institution (CDFI).

What is a CDFI?

Community Development Financial Institutions (CDFIs) are private financial institutions in the U.S. that provide credit and financial services to underserved markets and populations. They focus on promoting financial inclusion and economic development in economically distressed areas. CDFIs are generally certified by the U.S. Department of the Treasury and play a crucial role in supporting communities often overlooked by mainstream financial institutions.

Why are Native CDFI’s important?

Native Community Development Financial Institutions (CDFIs) play a crucial role in empowering Native American communities to overcome systemic obstacles to economic growth. These institutions address challenges such as inadequate infrastructure, limited access to affordable financial services, and insufficient workforce development opportunities.

According to a report by the Native CDFI Network, as of 2021 a striking 86% of Native communities lack even a single financial institution within their borders, highlighting the critical need for Native CDFIs. Over the past decade, these organizations have demonstrated their effectiveness in fostering thriving Native economies and communities.

By venturing into markets often deemed “high-risk,” Native CDFIs have become catalysts for local economic development. They facilitate the creation of businesses, generate employment opportunities, promote homeownership, and stimulate overall economic growth. Through tailored programs and services, Native CDFIs work to build financial assets among low-income populations and provide access to economic opportunities, contributing to the long-term prosperity of Native communities.

OUR MISSION IS TO EMPOWER NATIVE COMMUNITIES BY FOSTERING ECONOMIC SOVEREIGNTY.

WHAT WE DO

TICC addresses the systemic barriers that have historically excluded BIPOC entrepreneurs and tribal nations from economic opportunities by providing equitable access to:

- Capital

- Technical assistance

- Strategic investments in climate resilience

- Small business development

- Financial infrastructure through direct and indirect lending

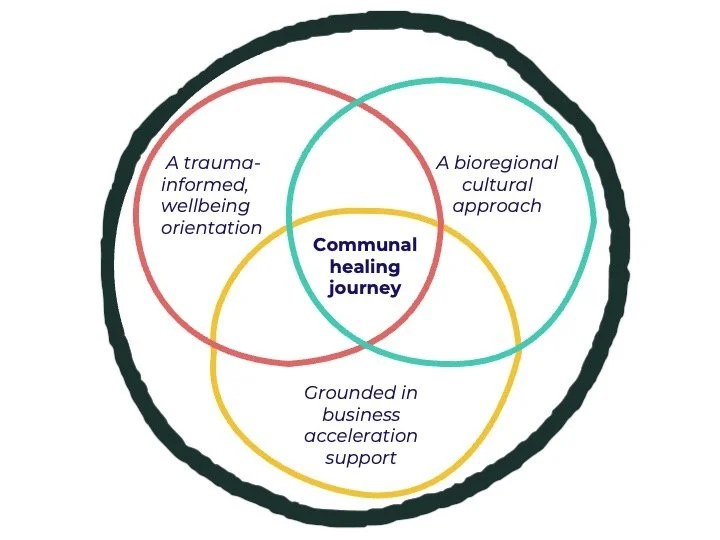

WHAT MAKES US UNIQUE

OUR IMPACT

Discover the meaningful projects and vibrant tribes we proudly support, each partnership reflecting our commitment to positive change and cultural preservation. Explore how our initiatives are making a real difference in communities around the world.

TICC achieves this mission and sustains its operations through philanthropic grants and senior, unsecured investments from those interested in providing impact investments to Native communities.

REASONS TO INVEST

Your investment in Turtle Island Community Capital does more than generate returns—it helps restore economic balance and builds lasting prosperity in Native communities while advancing climate resilience and cultural sovereignty.

The Current State

Our Solution

Native Community rates are 29.4% for individuals and 36% for families, significantly higher than the U.S. averages of 15.3% and 9.2% respectively, according to the Administration for Native Americans.

Provide technical assistance to advance economic sovereignty and generational wealth for Native communities.

There are no NCDFIs in lower New England.

Serve the indigenous populations in the Northeastern United States, including Boston, New York, and Washington D.C.

In 2023, the solar industry generated over $60 billion of private investment; most of which did not go to Native or LIDAC communities.

Offer development services and customizable loan packages focused on Native and underserved communities to build sustainability and resilience.

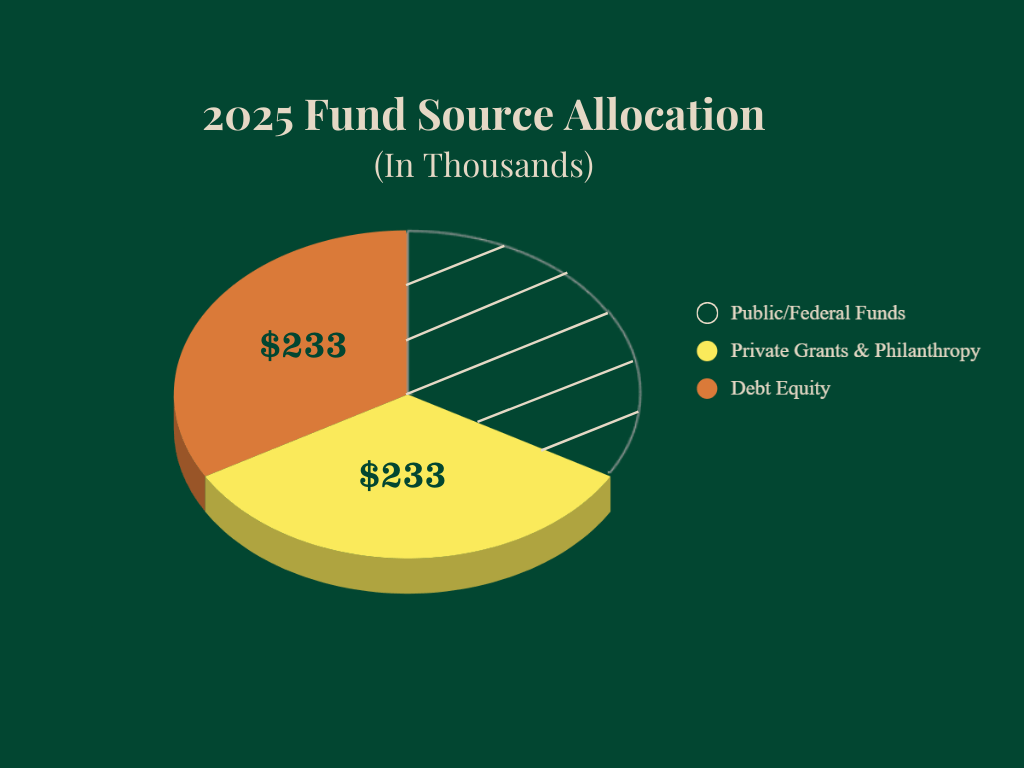

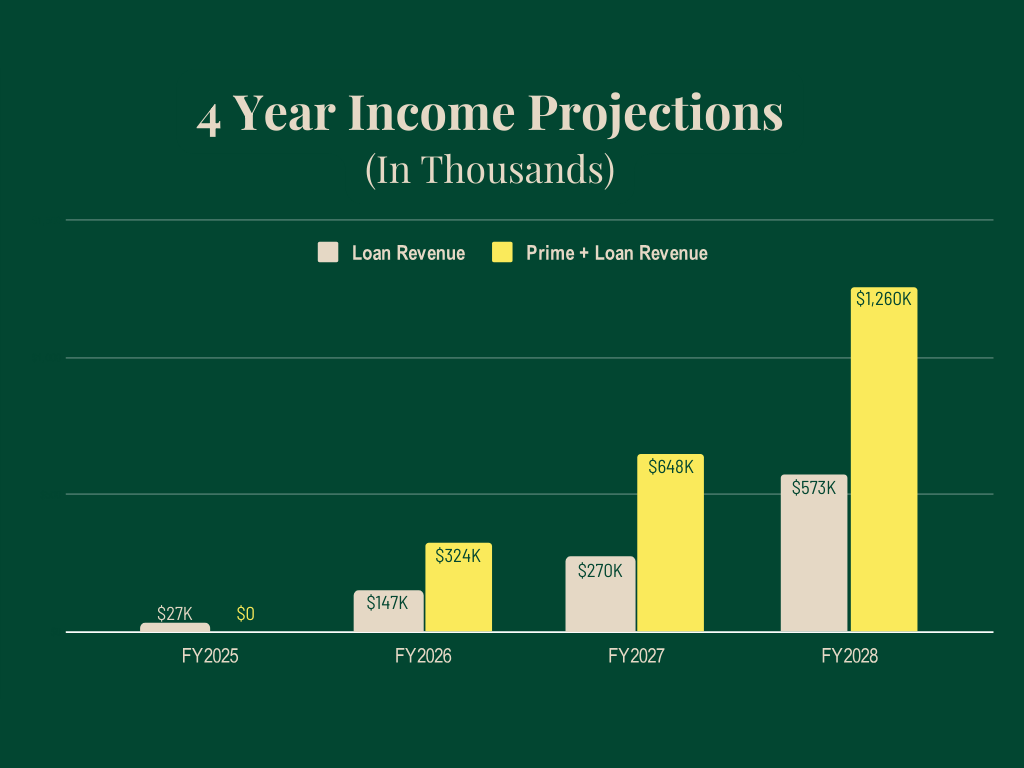

FINANCIAL PROJECTIONS

TICC’s financial roadmap reflects both our commitment to sustainable growth and our dedication to increasing capital flow to Native communities—demonstrating how mission-driven investing can create lasting impact while maintaining strong financial performance.

TARGET IMPACT INVESTMENT FUND SIZE

$1.3 Million

Complete financial projections are available upon request.

HOW TO INVEST

To invest and support our mission, email Alexander Sterling, Founder & CEO at a.sterling@turtleislandcommunitycapital.org or fill out the form below: